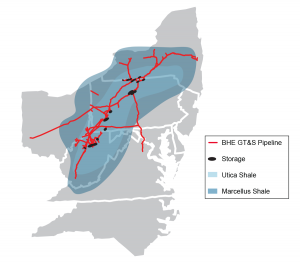

Red natural gas transmission lines sold to Berkshire Hathaway Energy Gas Transmission & Storage (BHE GTS)

RICHMOND, Va., July 5, 2020 /PRNewswire/ — Dominion Energy has announced that it has executed a definitive agreement to sell substantially all of its Gas Transmission & Storage segment assets to an affiliate of Berkshire Hathaway Inc. in a transaction valued at $9.7 billion, including the assumption of $5.7 billion of existing indebtedness.

“Over the past several years the Dominion has taken a series of steps – including mergers with Questar Corporation and SCANA Corporation, and the divestiture of Blue Racer Midstream and merchant generation assets – to increase materially the state-regulated nature of our profile, enhance the customer experience, strengthen our balance sheet, and improve transparency and predictability.

“We offer an industry-leading clean-energy profile which includes a comprehensive net zero target by 2050 for both carbon and methane emissions as well as one of the nation’s largest zero-carbon electric generation and storage investment programs. Over the next 15 years we plan to invest up to $55 billion in emissions reduction technologies including zero-carbon generation and energy storage, gas distribution line replacement, and renewable natural gas. In addition, between 2018 and 2025 we expect to retire more than four gigawatts of coal- and oil-fired electric generation.

Warren Buffett, chairman of Berkshire Hathaway, said: “I admire Tom Farrell for his exceptional leadership across the energy industry as well as within Dominion Energy. We are very proud to be adding such a great portfolio of natural gas assets to our already strong energy business.”

#######+++++++#######+++++++#######

Dominion, Berkshire abandon $1.3 billion Questar natural gas pipeline sale

From an Article by Jonathan Stempel, Reuters News Service, July 12, 2021

Dominion Energy Inc has abandoned the sale of the Questar natural gas pipelines to Warren Buffett’s Berkshire Hathaway Inc because of uncertainty over whether antitrust regulators would approve it. Berkshire Hathaway Energy had planned to acquire Dominion’s Questar Pipelines for $1.3 billion in cash and the assumption of $430 million of debt, as part of a larger purchase of Dominion’s natural gas transmission and storage business.

The Berkshire unit bought the remaining assets, including more than 5,500 miles (8,850 km) of gas transmission pipelines and 775 billion cubic feet of gas storage, in November 2020 for $2.5 billion in cash after adjustments plus $5.6 billion of assumed debt. [Related to the cancelled Atlantic Coast Pipeline project.]

This announcement has no impact on the rest of the purchase, which represented about 80% of the original transaction value, including the assumed debt, the companies said.

#######+++++++#######+++++++#######

Hastings Extraction Plant — Eastern Gathering and Processing (EGP) — Berkshire-Hathaway Energy Gas Transmission & Storage (BHE-GTS)

Information from the BHE-GTS Internet Sites, February 14, 2022

Positioned in the Marcellus and Utica production basins, Eastern Gathering and Processing (EGP) is well situated to assist producers requiring natural gas processing and transportation of their gas into the Eastern Gas Transmission and Storage system, with capacity serving multiple states in the Mid-Atlantic and Northeast regions.

An unregulated (non-FERC jurisdictional) subsidiary, EGP gathers, transports and processes natural gas, fractionates mixed natural gas liquids (NGL) and transports purity NGL products and tariff-quality natural gas to market. The business includes the Hastings processing and fractionation plant, Wetzel County, WV, capable of processing up to 180,000 mcf/day of natural gas and fractionating 12,000 barrels per day of mixed NGL’s. Also included is the Lightburn Extraction Plant with capacity to process an additional 40,000 mcf/day. The EGP assets are located in West Virginia and western Pennsylvania.

EGP’s Natural Gas Liquid Marketing Group sells over 100 million gallons annually of commercial grade purity propane, butane and natural gasoline to over 20 customers serving various industries including petrochemical, motor fuel refining, aerosols, butane lighters, retail propane and more. The marketing range of NGL’s produced at the Hastings plant reaches throughout the United States, Canada and Mexico.

#######+++++++#######++++++++#######

Dominion Energy to sell W.Va. natural gas utility for $690M

From an Article by Katherine Schulte, Virginia Business, February 11, 2022

Dominion Energy Inc. announced Friday it had signed a definitive agreement to sell its West Virginia natural gas utility to Washington, D.C.-based financial services company Ullico Inc.’s infrastructure business for $690 million. The sale of Hope Gas Inc., also known as Dominion Energy West Virginia (DEWV), is expected to close later this year.

Clarksburg, West Virginia-based DEWV has about 300 people and serves 111,000 West Virginia customers. The utility has 3,200 miles of gas distribution pipelines and more than 2,000 miles of gathering pipelines.

Ullico Inc.’s infrastructure business plans to integrate the utility with Hearthstone Utilities Inc., its portfolio company that owns and operates gas utilities in Indiana, Maine, Montana, North Carolina and Ohio. Hearthstone will move its headquarters to West Virginia.

Dominion Energy will continue to own and operate Mount Storm Power Station in Mount Storm, Grant County, West Virginia.

{ 2 comments… read them below or add one }

UPDATE: Tom Farrell dies at 66, the day after stepping down as leader of Dominion Energy

>>> From an Article by Michael Martz, Richmond Times Dispatch, April 2, 2021

Thomas F. Farrell II, a lawyer who rose to the top of Dominion Energy to dominate Virginia business and politics, has died of cancer at age 66, the day after relinquishing his role as executive board chairman of the energy company he had ruled for 15 years.

The day before his death, Mr. Farrell stepped down as executive chairman of the Dominion board, a role he created for himself more than six months ago under a succession plan that made Bob Blue the company’s CEO, but reporting to him.

He grew up in Fairfax County and never lost sight of what he saw as his obligation to his community, serving in leadership roles at the University of Virginia, his alma mater, and Virginia Commonwealth University, and helping Richmond overcome a shaky start to host an international cycling championship before a global audience in 2015.

Mr. Farrell also served as non-executive chairman of Altria Group Inc., the Henrico County-based parent company of Philip Morris USA. Altria announced last week that Mr. Farrell had notified the Fortune 500 company of his decision to retire from the company’s board following the completion of his current term in May.

Mr. Farrell was born in Okinawa, the son of a military officer who had attended the U.S. Military Academy at West Point. He later wrote and produced a film, “The Field of Lost Shoes,” about the role of the Virginia Military Institute cadets in the Civil War Battle of New Market. …… “I grew up with ‘duty, honor and country,’ which is the West Point motto,” he told The Times-Dispatch in 2017.

Mr. Farrell was similarly devoted to UVA. He attended the university as an undergraduate and received a law degree from the UVA’s School of Law. Later, he would serve as rector and a member of the board who guided both its governance and fund raising.

Mr. Farrell spent 15 years as a litigator, first at what was known then as Hunton & Williams and then Boothe, Prichard & Dudley, an Alexandria law firm that would merge into what was then called McGuire, Woods and Battle.

The two firms were central players in a bitter, highly public feud between what was known then as Dominion Resources Inc. and its single biggest asset, the Virginia Electric & Power Co., operating then as Virginia Power. Hunton & Williams represented the power company, while Mr. Farrell became a prominent member of the legal team at McGuire, Woods for the holding company. The battle ended with a series of truces, but Mr. Farrell moved to Dominion in mid-1995 and eventually became its general counsel.

Mr. Farrell rose in Dominion as the company made an ill-fated push into electric deregulation, which he later reversed — on the company’s terms — through a law enacted by the General Assembly in 2007, the year after he became the company’s CEO.

Since then, the power company has exerted its will in the shaping of state utility policy, constraining the power of the State Corporation Commission to regulate its earnings in Virginia, while enlarging its sources of electricity for a grid that serves more than 2.6 million customers in the state’s largest public utility monopoly. Dominion’s political victories made the company, and Mr. Farrell, the target of consumer advocates who felt the utility was reaping profits at the expense of captive ratepayers.

He also became a villain for environmentalists by proposing construction of the Atlantic Coast Pipeline. Dominion abandoned the $8 billion natural gas project last June, despite winning arguments that Mr. Farrell personally attended at the U.S. Supreme Court last year to allow construction of the pipeline beneath the Appalachian Trail in the Blue Ridge Mountains.

But Mr. Farrell also guided Dominion to become an industry leader in renewable energy. He sold the company’s natural gas storage and transmission businesses to Berkshire Hathaway for $10 billion at the same time Dominion canceled construction of the pipeline.

Dominion already was planning an initiative to invest big in off-shore wind production of electricity, leasing more than 113,000 acres of federally owned waters in the Atlantic Ocean 27 miles from Virginia Beach for what initially was a small, 12-megawatt pilot project with two wind turbines. The company plans to seek approval next year of a proposed wind farm that would include 188 turbines and generate more than 2,600 megawatts of electricity.

Again, Mr. Farrell turned to the General Assembly and allied with environmental groups to win passage of the Virginia Clean Economy Act last year that limits the SCC’s authority to stop the $8 billion project and commits Dominion’s electricity generation to emit no carbon dioxide or greenhouse gases by 2045.

He also was a leader of the GO Virginia initiative that became a template for regional cooperation in economic development, as well as a founding director of the Greater Washington Partnership, a corporate-led policy organization for the region stretching from Richmond through the Washington, D.C., area to Baltimore.

“I am stunned to hear of Tom’s passing,” said former House Speaker Kirk Cox, R-Colonial Heights, who served with Farrell on the GO Virginia board of directors. “I have had the honor of knowing him for many years, and my respect for him almost cannot be put into words.”

ULLICO Signs Agreement to Acquire Regulated Utility Platform, viz. Heartstone Utilities

Washington D.C. (January 27, 2021) – Ullico Inc. today announced that on December 22, 2020, its Ullico Infrastructure Fund signed a definitive agreement to acquire GEP Bison Holdings, Inc., which owns 100% of the equity of Hearthstone Utilities, Inc. “Hearthstone”), a holding company that owns and operates six natural gas local distribution companies across five states in the United States. Ullico will acquire GEP Bison Holdings, Inc. from BlackRock Real Assets’ Global Energy & Power Infrastructure Funds (“GEPIF”).

“Hearthstone is a geographically diversified natural gas distribution platform with strong, integrated local leadership,” said Rohit Syal, head of acquisitions for Ullico’s infrastructure business. “For the Ullico Infrastructure Fund, this platform represents a unique opportunity to wholly-own a regulated business.”

“Ullico is proud to be the owner of a company that provides essential services, tangible work opportunities and is committed to the betterment of the communities which it serves,” said Edward M. Smith, President and CEO of Ullico Inc.

Hearthstone serves over 82,000 residential, commercial, and industrial customers across Indiana, Maine, Montana, North Carolina, and Ohio. Serving more than 30,000 customers in each of Ohio and Montana, Hearthstone is one of the largest independent natural gas distribution companies in these two states. Hearthstone distributes approximately 26 billion cubic feet of natural gas and operates approximately 3,300 miles of distribution and transmission pipelines. The Hearthstone portfolio offers a unique opportunity to acquire a large-scale, regulated gas distribution company with a long-term contracted revenue structure, critical importance in its markets and stable cash flows.

“Ullico’s vision is to invest patient, long-term capital into these core infrastructure assets in a manner that brings experienced ownership, stability, a long-term vision, consistently available capital, access to best-inclass operating partners and a commitment to the economic success of the communities local to each investment,” said Sonia Axter, head of asset management for Ullico’s infrastructure business.

Dave Cerotzke, Hearthstone’s President and Chief Executive Officer, commented, “This new partnership with Ullico will allow Hearthstone to maintain our strong dedication to providing safe, clean, reliable and affordable energy to our customers, ensure continuity of management and processes for our regulators, provide continuous opportunity for our employees, and further support expanding the number of customers that have access to our responsive, quality service.”

The transaction is subject to, among other customary closing conditions, the approvals of the Maine Public Utilities Commission, Montana Public Service Commission, North Carolina Utilities Commission, and Public Utilities Commission of Ohio and the expiration of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act. Ullico expects to receive all such approvals and complete the transaction in the second half of 2021.

Ullico Inc., through the Ullico Infrastructure Fund, currently has investments in the water, wastewater, telecommunications, electricity transmission, power generation, transportation and gas transmission sectors and is exploring opportunities in all core sectors.

RBC Capital Markets acted as Ullico’s financial advisor and Milbank LLP acted as legal counsel. Credit Suisse acted as GEPIF’s financial advisor and Simpson Thacher & Bartlett LLP acted as legal counsel.

>>> About Ullico

For more than 90 years, Ullico has been a proud member of the labor movement, keeping union families safe and secure. In 2010, the Ullico Infrastructure Fund (UIF) was established to assist in the construction, maintenance and refurbishment of America’s infrastructure. As of December 31, 2020, UIF had approximately $3 billion in assets under management on behalf of 133 investors, with 18 portfolio investments comprising all major sectors.

From insurance products that protect union members, leaders and employers, to investments in building and infrastructure projects that have created thousands of union jobs, our customers continue to trust us with protecting their families, employees and investments. The Ullico Inc. Family of Companies includes: The Union Labor Life Insurance Company; Ullico Casualty Group, LLC; Ullico Investment Company, LLC (Member FINRA/SIPC); Ullico Investment Advisors, Inc.; and Ullico Benefit Solutions, LLC. For additional information, visit visit http://www.ullico.com.